michigan sales tax exemption industrial processing

The industrial processing exemption is limited to specific property and activities. The Michigan Supreme Court held that sales of bottle and can recycling machines that help retailers comply with Michigans bottle-deposit law may qualify for the states sales and use tax exemption applicable to machinery used in an industrial-processing activity.

4225 exempt businesses which might not be eligible for industrial processing exemption covering purchases of protective gear and will help businesses buy certain.

. Personal Protective Equipment Qualifies for Industrial Processing Exempt. Michigan offers an exemption from state sales tax on the purchase of electricity natural gas and water used in qualifying production activities. Michigan bills HB.

Michigan Sales and Use Tax. Examples of other property eligible for the industrial processing. The industrial processing exemption is clearly available for machinery and equipment used during the manufacturing process.

The State of Michigan allows an industrial processing IP exemption from sales and use tax. Michigan defines industrial processing as the activity of converting or conditioning tangible personal property by changing the form composition quality combination or character of property for ultimate sale at retail or for use in the manufacturing of a product. Industrial Processors An industrial processing exemption is allowed for property which is used or consumed in transforming altering or modifying tangible personal property by changing the form composition or character of the property for ultimate sale at retail or for sale to another processor for further processing.

The State of Michigan allows an industrial processing IP exemption from sales and use tax. The General Sales Tax Act defines industrial processing as the activity of converting. The department does not issue tax-exempt numbers.

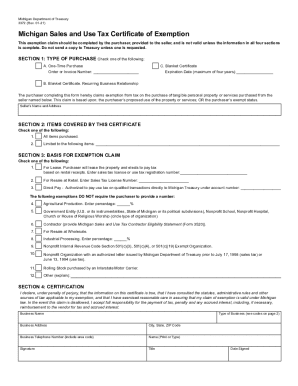

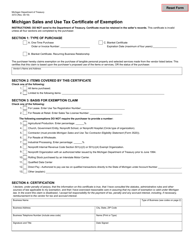

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. PPE or safety equipment purchased by a person eligible for the industrial processing exemption is exempt from Michigan sales and use tax if used or consumed in an exempt industrial processing activity. Industrial processing by an industrial processor is exempt.

The Michigan Department of Treasury DOT had argued that the. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

Sales or rentals for industrial processing or for agricultural production. Michigan labs will have to register to collect and remit sales tax and also complete a form to take advantage of the industrial processing exemption on qualifying supplies materials and equipment. Industrial processing starts when tangible personal property moves from raw materials storage and ends when finished goods first come to rest in inventory storage.

The Michigan Supreme Court held that sales of container bottle and can recycling machines and repair parts qualify for the states sales and use tax exemption on machinery used in industrial processing. Michigan Holds that Recycling Machines Qualify for Industrial Processing Exemption. More information regarding Sales Tax is available at 517-636-6925 and in the business tax registration booklet.

SALES TAX - Total Gross Sales for the Tax Industrial processing is the activity of converting or. Some transactions exempt from the sales and use tax are. The GSTA and UTA generally define industrial processing as the activity of converting or conditioning tangible personal property by changing the form.

Sales or rentals to the federal government or state government or. Exemption Language of MCL 20554t 1 a Tangible personal property is exempt from tax when used by an industrial processor for use or consumption in industrial processing. This tax exemption is authorized by MCL 20554t 1 a.

Sales or rentals outside the State of Michigan. The Michigan Department of Treasury unsuccessfully argued that the machines may not qualify for. All claims are subject to audit.

The industrial processing exemption is limited to specific property and activities.

Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Exemption For Manufacturing

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Exemption For Manufacturing

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller